So quick explanation of

today's chart, back to the importance of fib levels.

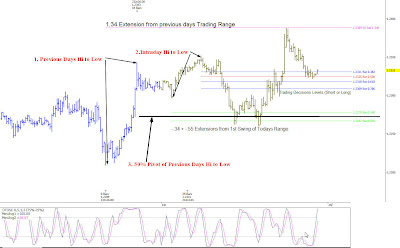

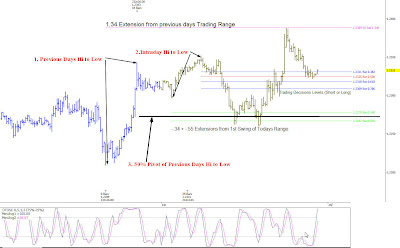

2 sets of fibs have been marked up onto this 15min chart of today's euro/

usd.

1. Previous days High to Low (Blue Bars on the Chart. Which gave the 1.34 Extension Level (pink line)

2.

Toady's High to Low as you would have seen at the start on the London session. This gave us the

intra-day fibs marked as (decision levels on the chart short or long) and the green -.34 + -.55 extensions.

3. And lastly the black 50% pivot level of the previous days range (high to low).

Sounds a lot of marking + levels, however once you read up on

Fibonacci, you'll quickly pick up the

terminology and more importantly how price respects these

mathematical levels.

So onto my analysis :-

From the

London open, price breaks the 50% + 61.8%

intraday fibs which indicates short. What area's could you potentially take profit at if you had taken these shorts ? well look at green

intraday projections, these two levels are hit bang on.

This area is also the 50% pivot from the previous days high to low (Black Line marked 3). From here price finds support and starts to rally back up through

intraday fibs (78.6 then 50 finally breaking the 38.2% level. Indicating potential long trade ?

Well if you reversed and took this long where could you take profit at ? Amazingly enough look at the 1.34 extension from yesterdays trading range (pink line).

Price hits this target to the pip!!!!!

Amazing huh, all from

Fibonacci projections in the past, predicting where price could go.

Trading is all about high probability entries, limited capital exposure with

pre-defined profit target areas.

However its easy to markup charts after the day is over, real money makers trade these situations live with real £££ on the line, this is where the human emotions of fear and greed kick in.

Position update on the AUDUSD, price seems to be making a correction.

Position update on the AUDUSD, price seems to be making a correction. Look at this example on the GBPJPY from the 20th June to market close today, 1 Hour Data.

Look at this example on the GBPJPY from the 20th June to market close today, 1 Hour Data. So quick explanation of today's chart, back to the importance of fib levels.

So quick explanation of today's chart, back to the importance of fib levels.

As explained on the chart itself, DT6's new wave scan routines have identified the end of a potential wave 2.

As explained on the chart itself, DT6's new wave scan routines have identified the end of a potential wave 2. I have used Fibonacci levels before, although I have to admit not really digging to deep and sticking with the standard retracement / extension levels.

I have used Fibonacci levels before, although I have to admit not really digging to deep and sticking with the standard retracement / extension levels.